Post Office PPF Scheme: Invest ₹72,000 Annually to Earn ₹19.5 Lakh in 15 Years!

The Post Office Public Provident Fund (PPF) Scheme has long been a go-to investment option for Indian savers seeking security, tax benefits, and steady growth. With an attractive interest rate, government-backed assurance, and long-term compounding benefits, this scheme offers a unique opportunity for individuals to save and invest for their future.

Here’s how investing just ₹72,000 per year can help you achieve ₹19.5 lakh in returns in 15 years, all while saving on taxes!

How the Post Office PPF Scheme Works

The Post Office PPF scheme allows investors to deposit a minimum of ₹500 and a maximum of ₹1.5 lakh annually. However, the scheme’s most popular investment strategy involves contributing ₹72,000 each year (₹6,000 per month) to achieve a healthy balance over time.

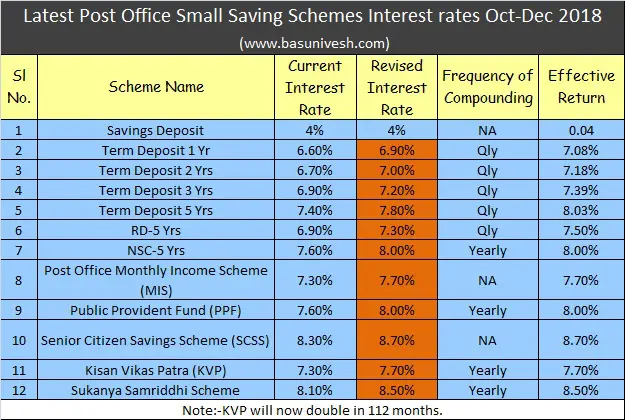

The interest rate for the PPF scheme is currently 7.1% per annum, compounded yearly. While the rate may change periodically based on government decisions, the PPF remains one of the most secure long-term investment options in India due to its government backing.

Compounding Interest: A Key to Wealth Building

The beauty of the PPF scheme lies in its ability to generate returns through compound interest. In simple terms, compound interest means that not only are your original contributions growing, but your earned interest also earns interest. This exponential growth makes it a powerful tool for long-term wealth accumulation.

For instance, by investing ₹72,000 annually, your total contribution over 15 years would be ₹10.8 lakh. However, due to the magic of compounding, the final amount you could earn in 15 years will be approximately ₹19.5 lakh, depending on the prevailing interest rate at the time. This makes the PPF an excellent vehicle for wealth-building over the long term.

Tax Benefits of PPF

Another major advantage of the PPF scheme is the tax benefits it offers. Contributions made to the PPF account qualify for tax deductions under Section 80C of the Income Tax Act, which allows taxpayers to reduce their taxable income by up to ₹1.5 lakh per year.

Additionally, the interest earned on the PPF is tax-free. This is a key differentiator compared to other fixed-income investments, such as fixed deposits, where the interest is taxable.

Moreover, the maturity amount (principal + interest) is also tax-free, making the PPF one of the most attractive investment options for individuals looking to build wealth without worrying about the tax implications.

Advantages of Post Office PPF Scheme

- Government Backing: The PPF is backed by the government of India, ensuring safety for investors. This makes it one of the most secure forms of investment available.

- Flexible Investment Options: While the minimum contribution is ₹500 annually, you can choose to invest any amount up to ₹1.5 lakh per year, making it a flexible investment option for people at different income levels.

- Long-Term Financial Planning: The PPF has a lock-in period of 15 years, which encourages long-term financial planning. Early withdrawals are restricted, making it a great way to secure funds for future goals like children’s education, retirement, or buying a home.

- Loan Facility: After the 3rd year of investment, you can take a loan against your PPF balance, providing liquidity in case of emergencies. This adds another layer of flexibility to the scheme.

- Ease of Access: You can easily open a PPF account at any post office or through major banks. The process is straightforward, and deposits can be made both offline and online.

Post Office PPF Returns: Realizing Your ₹19.5 Lakh Goal

If you deposit ₹72,000 annually for 15 years at an interest rate of 7.1% (compounded annually), here’s what your returns could look like:

- Yearly Contribution: ₹72,000 (₹6,000 per month)

- Total Contribution over 15 years: ₹10.8 lakh

- Expected Returns: ₹19.5 lakh (approx.) after 15 years

This calculation assumes that the interest rate remains stable at 7.1%, although the rate could vary slightly during the term of your investment. Even with small fluctuations in interest, the PPF’s compound interest effect can ensure substantial growth.

When to Invest in PPF

The best time to start investing in the Post Office PPF scheme is as early as possible. The earlier you begin, the more you benefit from compounding. Starting at a young age can help you build a solid financial foundation for the future, whether it’s saving for your child’s education, your retirement, or any other long-term goals.

Is the Post Office PPF Scheme Right for You?

The Post Office PPF scheme is ideal for conservative investors looking for a secure, long-term investment option with tax benefits. It is well-suited for individuals with a steady income who are interested in building a retirement corpus or saving for future financial goals.

For risk-averse investors who prioritize safety over high returns, the PPF scheme offers peace of mind with guaranteed returns and no market-linked risks. It’s also great for people who have a long-term view of their finances and are committed to saving regularly.

Conclusion: Why Choose the Post Office PPF Scheme?

In a world of fluctuating markets and economic uncertainties, the Post Office PPF scheme remains one of the safest and most reliable ways to grow your wealth. With tax benefits, compound interest, and government backing, it offers the perfect balance of security and growth. By investing just ₹72,000 annually, you can achieve a whopping ₹19.5 lakh in 15 years, all while benefiting from tax-free returns.

Whether you’re saving for retirement, your child’s future, or simply building your financial safety net, the Post Office PPF is a smart, effective option to consider.

[…] Also read-Post Office PPF Scheme: Invest ₹72,000 Annually to Earn ₹19.5 Lakh in 15 Years! […]